Subsidence claims could push house insurance premiums up

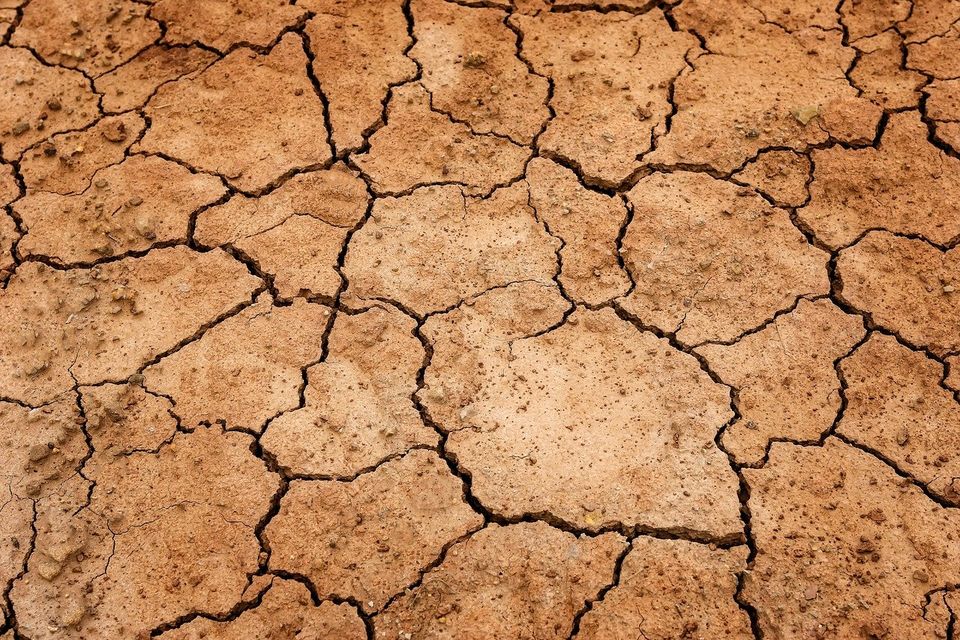

Home Insurance customers have benefited from a prolonged series of price cuts, with the average cost of premiums dropping to £137 up until January of this year. This was primarily due to the need for providers offer competitive pricing. However, due to an increase in subsidence claims, Consumer Intelligence is advising of an average increase of 1.7% in the cost of premiums, and the blame can be placed on last summer’s unprecedented heatwave.

As reported at the start of 2019, the hot weather experienced last year caused varying levels of damage to homes, with cracked doors, windows and walls the most frequent issues cited by homeowners. It’s taken some time, but after over 10,000 subsidence claims as a result of the hot weather, the knock-on effects are starting to be felt.

Whilst homeowners in Wales and the Southwest are getting off the lightest, thanks to their low annual bills of £121 and £123 respectively, Londoners have seen their prices rise to £181, up 1% in the last year. The East Midlands isn’t too far behind, with an increase of 0.8%.

Those with new homes can expect to pay less for their home insurance premiums, with houses built post-2000 costing an average of £128 to insure. The opposite end of the spectrum sees houses built prior to 1895 can expect a hefty 30% increase to an average of £167.

“Competition in the home insurance market is keeping

premium increases to a minimum with only a few areas of the country seeing

limited price rises,” commented Consumer Intelligence pricing expert John

Blevins.

“But the past six months have seen premiums starting to rise and that may be an

indication of things to come with all parts of the country likely to be

affected.

“Claims costs remain the main driver of premiums that we see, and the industry as a whole is experiencing a rise in subsidence claims which are costly for insurers and that will have an impact on total claim costs and prices.”

Recent Posts